World's Biggest Containership "Hard Aground" As Baltic Dry Crashes Below 300 For First Time Ever

Before this year the lowest level The Baltic Dry Index had reached was 556 in August of 1986 and the highest was in June 2008 at a stunning 11,612. Today saw the freight index hit a new milestone however, crashing through the 300 barrier for the first time ever - at 298, this is almost 50% below the previous record low.

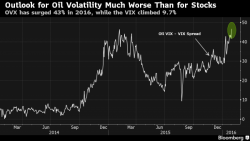

Commodities obviously are saying something very different from "the market"...