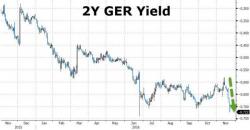

As Investors Dump Treasuries, German Bonds Are Panic-Bid To Record Low Yields

2Y German bond yields are collapsing, hitting record lows at -72bps this morning as Commerzbank reports a collateral squeeze into year-end. Since the election, the spread between 2Y UST and 2Y GER has exploded by over 50bps, spiking Treasuries to their 'cheapest' to Bunds since 2005...

Bloomberg reports that Commerzbank says in note that the demand for German collateral ahead of year-end continues to rise, reflected in repo funding levels reaching new lows; 3- month GC moves below -70bps, with little on the offer side