How Vancouver Is Being Sold To The Chinese: The Illegal Dark Side Behind This Real Estate Bubble

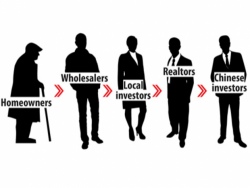

One month ago, when describing the latest in an endless series of Vancouver real estate horror stories, in this case an abandoned, rotting home (which is currently listed for a modest $7.2 million), we explained the simple money-laundering dynamic involving Chinese "investors" as follows.