A Delighted Wall Street Reacts To The French Election

With European stocks on fire, and US futures moving fast to recoup recent all time highs, it is no surprise that Wall Street is feeling particularly bullish this morning.

With European stocks on fire, and US futures moving fast to recoup recent all time highs, it is no surprise that Wall Street is feeling particularly bullish this morning.

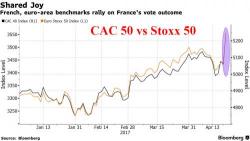

Risk is definitely on this morning as European shares soar, led by French stocks and a new record high in Germany's Dax, after a "French relief rally" in which the first round of the country’s presidential elections prompted investors to bet that establishment candidate Emmanuel Macron will win a runoff vote next month, and who is seen as a 61% to 39% favorite to defeat Le Pen according to the latest just released Opinionway poll.

For those who may have missed yesterday's events, here is a quick recap from DB:

Most of the results are in, and while it remains close, Macron will likely be the winner of the first French presidential round and is set to face Marine Le Pen in the runoff.

What does that mean for various asset markets and the bigger macro picture? Here are two forecasts, just released from Goldman and Citi.

First, Goldman Sachs:

Global markets were oddly calm on Friday, the last day of trading before the first round of France's closely fought presidential election, with European stocks posting modest declines ahead of Sunday's main event, Asian shares rising, and set for first weekly gain in the past month, while U.S. futures were unchanged. French bond yields hit three-months low even as the euro has seen some recent weakness.

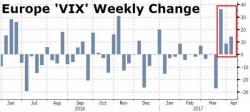

With little more than two weeks to go before the first round of French elections, expectations for sizable fluctuations in European markets are growing.

As Bloomberg reports, the VStoxx Index, which measures volatility bets based on options on the Euro Stoxx 50 Index, has rebounded from suppressed levels and is heading for a third consecutive weekly advance.

That’s its longest rising streak since before the U.K. referendum on European Union membership last year.