Global Stocks Soar To Record Highs On "Dovish" Fed, Dutch Vote

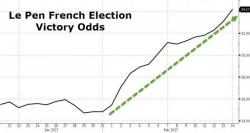

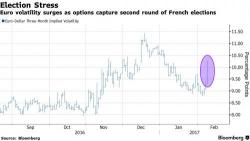

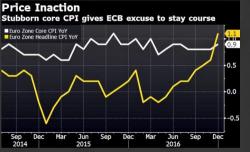

World stock indexes soared to record highs on Thursday while the dollar traded close to a one-month low after the Federal Reserve hiked U.S. interest rates but signaled no pick-up in the pace of tightening. European and Asian were broadly higher this morning, with S&P tagging along, driven by two main events: the latest "dovish" Fed rate hike, and the Dutch election results, in which Geert Wilders performed worse than some expected, reducing concerns of Eurozone political risk, and broadly seen as a sign of support for Europe's establishment.