Asian Stocks Smash Records; Dollar Slides As Crude Surges To July 2015 Highs

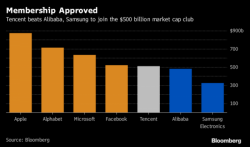

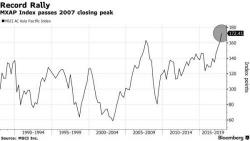

Global shares hit another record high on Wednesday, propelled higher by what increasingly more call (ir)rational exuberance, and investors’ unflagging enthusiasm for tech stocks. That said, S&P futures are unchanged the morning before Thanksgiving (at least before the market open ramp), as are European stocks (Stoxx 600 is flat), despite the euphoria in the Asian session which saw the MSCI Asia Pac index hit a new all time high...