KiNG OF THe MoRoNS...

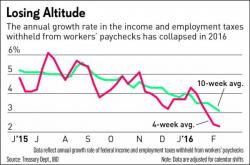

Two weeks ago, we looked at what is perhaps the best coincident indicator of the true, not-seasonally adjusted, picture of the US labor market, namely withholdings of income and employment taxes. We reported that while for most of 2015, tax withholdings rose at a rate of 5% or more from a year ago, on the back of job growth and gains in wages, commissions and other incentive pay, in recent months there has been a substantial dropoff in this key indicator.

Following yesterday's modest drop in US crude production and yuuge build in inventories, headlines about possible Venezuela meetings sent algos into panic-buying mode. This morning the headlines are from Nigeria, whose Petroleum Minister "expects a dramatic price move" claiming a meeting between OPEC and NOPEC will happen on March 20th. Combine that idiocy with significant US Dollar weakness this morning and the surge in Oil ETF share creation and the perfect storm of higher prices in oil (as hedgies pile in).

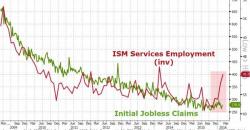

For many months, the general consensus was that the "malaise" in US manufacturing (which is clearly in a recession) is isolated, and would not spread to the service sector. That is no longer the case.

As a very gloomy Markit report noted earlier,

What a different four weeks makes.

Four weeks ago, the S&P 500 had just taken out critical support. Everyone was panicking that the market was about to implode.

1. At that time, China was continuing to devalue the Yuan as its economy collapsed.

2. Europe was tumbling based on Draghi’s inability to generate inflation.

3. The US economy was rolling over sharply as deflation arose courtesy of US Dollar strength and a Fed rate hike.