Why Bank Of America Just Said To Go Long "Cash & Volatility", In Charts

JPM, Citi, UBS, and now one of the Wall Street strategists whose perspective we respect the most, BofA's Michael Harnett, who quite clearly disagrees with the official BofA "straight to CNBC" mouthpiece Savita Subramanian, is out with a note in which he is telling reders to get out of stocks, go into cash expecting a short sharp pullbacks in risk assets (e.g. SPX to 1850-1900), and be long volatility.

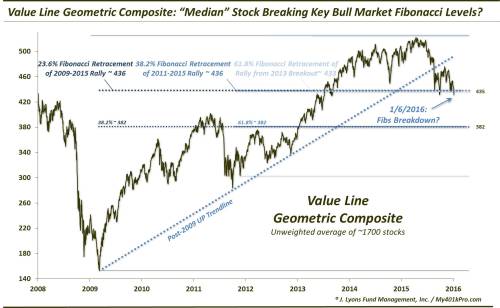

From his report: