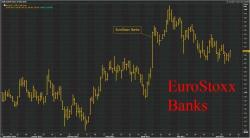

Italy Bank Bailouts Send European, Global Stocks Higher; Gold Flash Crashes

S&P futures point to a higher open following gains in Asian markets supported by stronger commodities but mostly European bourses, which are sharply higher following the €17 billion bailout of the two Veneto banks in Italy, the biggest taxpayer funded bank rescue in modern Italian history, as well as Dan Loeb's activist campaign of the world's biggest food company, Nestle which sent the stock up 5%, and finally Germany's Ifo business climate index which hit new all time highs.