Europe Slides For Third Day As Oil Attempts A Rebound; US Futures Flat

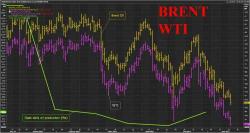

US equity futures were marginally in the red, while Asian markets rose and European stocks dropped. WTI oil rose 0.6% to $42.79 as some suggest the time to go long has arrived; oil tumbled 2.3% in the previous session. The Bloomberg Dollar Spot Index fell 0.1 percent.

Here are the main market developments while you were sleeping.