"It's Like Buying A Dream" - Mrs Watanabe And South Korean Investors Fuel Bitcoin's Meteoric Rise

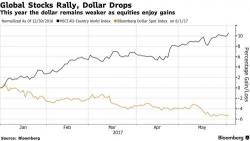

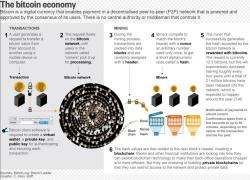

Bitcoin’s 150% surge since the beginning of the year has caught the attention of “Mrs. Watanabe,” the metaphorical Japanese housewife investor, and a legion of South Korean retirees who’re hoping to escape rock-bottom interest rates by investing in cryptocurrencies, according to Reuters.