Safe Havens Rise As Jittery Investors Eye Rising Geopolitical Concerns

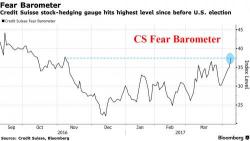

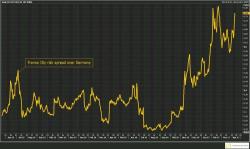

With volume starting to fade ahead of Friday's holiday, and geopolitical concerns growing as a US aircraft carrier approaches North Korean, S&P futures pointed to a slightly lower open, in line with stock markets in Europe and Asia. Safe havens such as gold and treasuries strengthened along with Japanese yen, which erased all of yesterday's losses and neared its 110 support on investor caution about global security risks and the future of U.S. interest rates after Yellen's Monday speech failed to provide clarity.