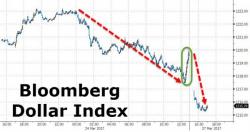

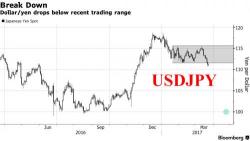

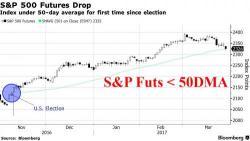

Global Stocks Slide, S&P Futures Tumble Below 50DMA As "Trump Trade" Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months.