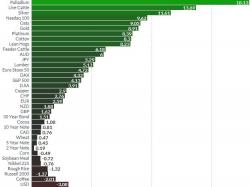

Gold, Silver Rise 2.5% and 3.2% As ‘Trump Trade’ Fades

Gold, Silver Rise 2.5% and 3.2% As ‘Trump Trade’ Fades

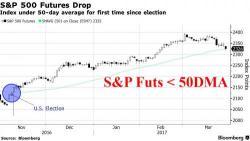

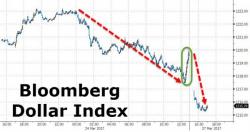

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The 'Trump trade' is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening.