Paul Singer Warns About Chinese Economic Bubble

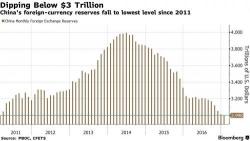

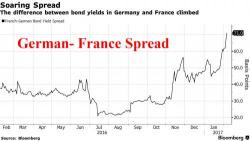

Paul Singer, founder and President of Elliot Management Corporation is known for being a skeptic of traditional market pundits. In his fourth quarter letter, he made several different predictions about the market. He acknowledged the highly unpredictable environment that we have highlighted before in our articles about Trump and the markets. The letter also contains a specific warning about the worsening situation in China.