US Futures, Oil Flat As Greenback Rises Despite Mnuchin's "Strong Dollar" Warning

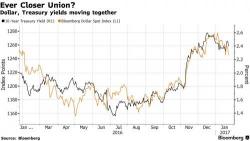

US equity futures were flat, European stocks rose and Asia was mixed after the dollar posted a modest rebound overnight despite Mnuchin's "strong dollar" comments, while oil was flat and gold fell, as investors focused on President Donald Trump’s plans to boost growth. The pound fell after a U.K. court ruled that Parliament must vote on triggering Brexit.