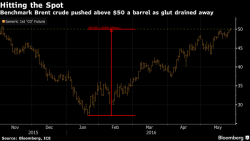

Futures Levitation Continues As Brent Rises Above $50 For First Time Since November

In what has been another quiet overnight session, which unlike the past two days has not seen steep, illiquid gaps higher in US equity futures (the E-mini was up 3 points and accelerating to the upside as of this writing so there is still ample time for the momentum algos to go berserk), the main event was the price of Brent rising above $50 for the first time since November with WTI rising as high as $49.97.

As shown in the chart below, Brent crude surpassed $50 a barrel for the first time since November, lifting commodity companies and buoying currencies where oil is produced.