'There Will Be Banker Blood': Why JPM Is Afraid Of "Quiet Trading Floors"

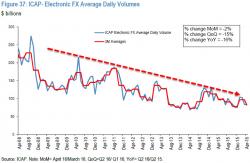

With banker bonuses set to drop this year, it should be no surprise that things are not all sunshine and roses on Wall Street. After 30 years of dramatically outperforming Main Street, Wall Street wages may be set for some mean-reversion as JPMorgan analysts take an ax to the biggest global investment banks' earnings. As Bloomberg reports, "quiet trading floors" are set to depress global investment banks’ second-quarter revenue 24 percent, with weakness across equities, interest rates, currencies, with a regionally-driven weakness from Asia.