EU-Turkey Migrant Deal Unravels Turning Greece Into Massive Refugee Camp

Submitted by Soeren Kern via The Gatestone Institute,

Submitted by Soeren Kern via The Gatestone Institute,

After two violently volatile days in which the market soared (Monday) then promptly retraced all gains (Tuesday), the overnight session has been relatively calm with futures and oil both unchanged even as the BBG dollar index rose to the highest level since April 4. This took place despite a substantial amount of macro data from both Japan, where the GDP came well above the expected 0.3%, instead printing 1.7% annualized, which pushed stocks lower as it meant the probability of more BOJ interventions or a delay of the sales tax hike both dropped.

It has been more of the same overnight, as global stocks piggybacked on the strong US close and rose despite the lack of good (or bad) macro news, propelled higher by the two usual suspects: a higher USDJPY and a even higher oil, if mostly early on in the trading session.

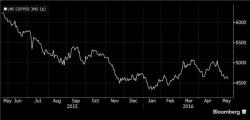

Yes, the oil squeeze higher continues, and as the charts below courtesy of Andy Critchlow show, Brent is now 82% higher in the past 82 days...

... while crude has had its strongest rally since 2010.

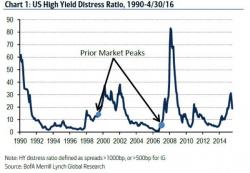

Over the weekend, we were surprised to read that none other than recent market cheerleader Goldman Sachs had come up with six reasons why its chief equity strategist believes the market is poised for a material draw down (read "big drop") in the coming weeks. Among these were the following:

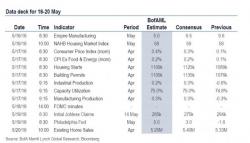

After last week's key event, the retail sales number, which the market discounted as being too unrealistic (and overly seasonally adjusted) after printing at a 13 month high and attempting to refute the reality observed by countless retailers, this week has a quiet start today with no data of note due out of Europe and just Empire manufacturing (which moments ago missed badly) and the NAHB housing market index of note in the US session this morning.