The Reason Why Oil Dropped: Saudis Set To Boost Production In Scramble For Chinese Demand

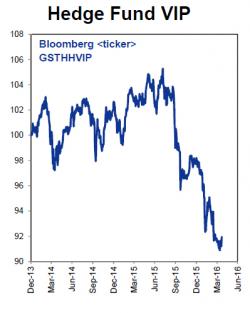

After meandering steadily higher for the past week, and completely ignoring the negative newsflow out of the Doha meeting, today oil took an unexpected leg lower to 4-day lows, leaving many stumped: what caused this drop?

The answer, according to Citi, is the realization Saudi Arabia is actually making good on its threat to boost production (recall that just one day ahead of Doha, Saudi deputy crown prince bin Salman said he could add a million barrels immediately) something we noted a month ago in "Why Saudi Arabia Has No Intention To End The Oil Glut."