To BREXIT Or Not To BREXIT...

Submitted by by Erico Matias Tavares via Sinclair & Co.,

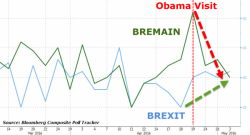

On 23 June the British will vote in a referendum to decide whether their country should remain in or leave (BREXIT) the European Union (EU). The importance of this event cannot be overstated, since it will impact the future of the UK – and very likely that of Europe – for decades to come.