Frontrunning: April 14

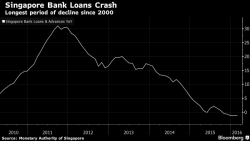

- Global shares reach four-month high, forex hit by Singapore sting (Reuters)

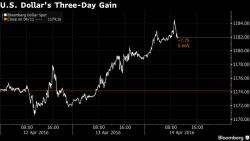

- Dollar Rally Hits Commodities as Europe Halts Global Stock Gains (BBG)

- Currencies Across Asia Fall Sharply Against U.S. Dollar (WSJ)

- IEA expects limited impact from oil output freeze at Doha (Reuters)

- IEA Sees Oil Oversupply Almost Gone in Second Half on Shale Drop (BBG)

- BofA Profit Declines 13% on Trading Slump, Energy Reserves (BBG)

- BlackRock quarterly profit falls 20 percent (Reuters)