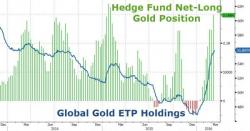

From "Ugly-Stepchild" To "Beauty Queen" - Gold ETF Holdings Surge To 18-Month Highs

Despite Goldman Sachs "short gold" recommendation - which came within pennies of being stopped out last week - traders, investors, and safe-haven seekers continue to push into the precious metals.