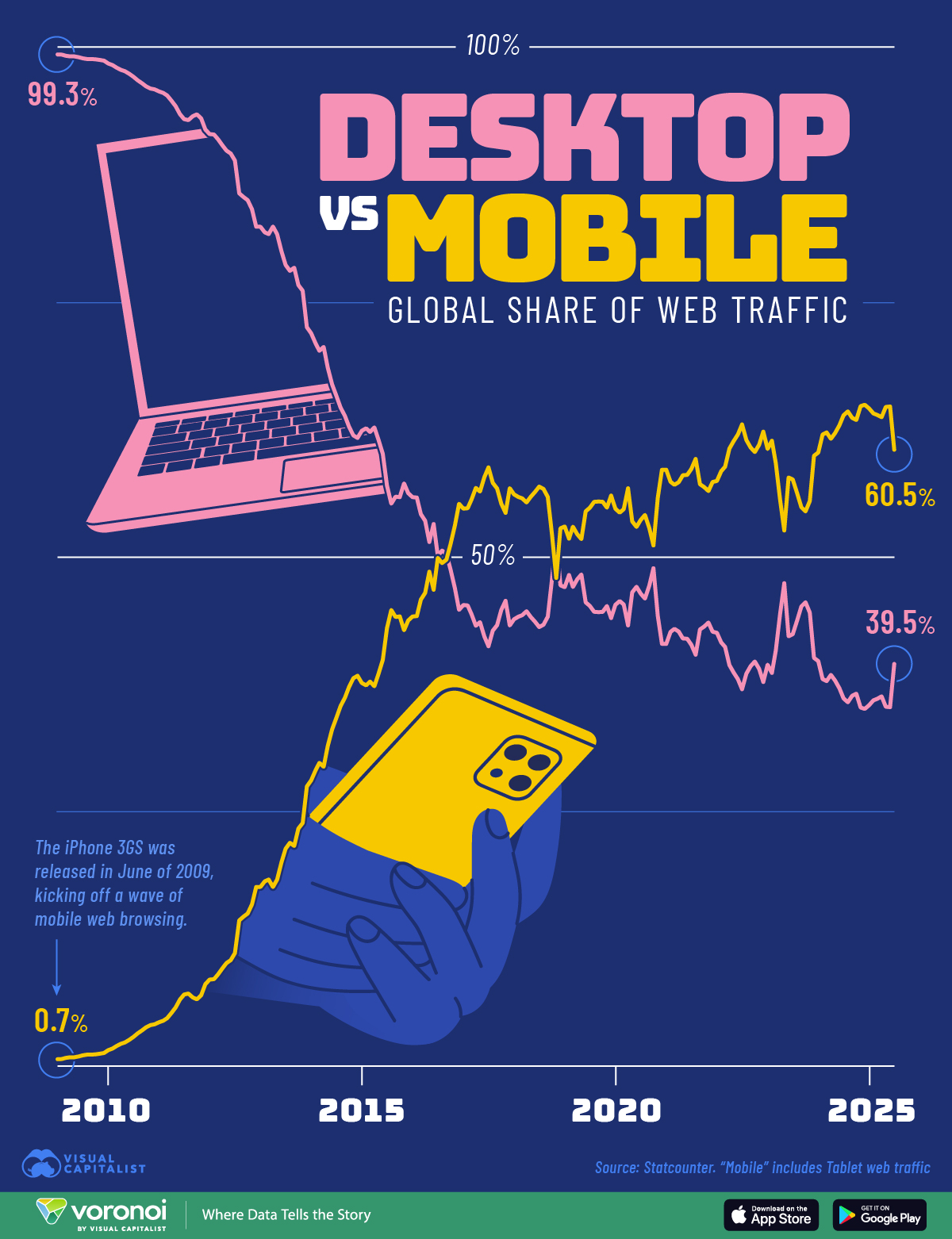

Visualized: Desktop vs. Mobile Global Web Traffic Over Time

![]()

See this visualization first on the Voronoi app.

Use This Visualization

Visualized: Desktop vs. Mobile Global Web Traffic Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways