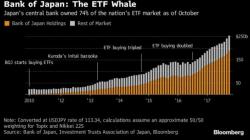

After $150 Billion Buying Binge, 'Tokyo Whale' Seen Paring Back ETF Purchases In 2018

A few months ago, we noted that the Bank of Japan had decided to throw every textbook out of the window and crank their plunge-protection to '11'after reports surfaced that they owned a staggering 75% of Japan's ETFs.

The BOJ first started their buying spree in December 2010 - when they held no ETFs at all - and have since accumulated some $150 billion in aggregate holdings. The buying was all as part of unprecedented "economic stimulus" which has undoubtedly contributed to the Nikkei 225 Stock Average surging roughly 125% since December 2010.