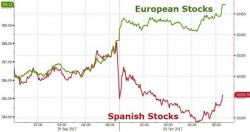

Global Stocks Hit Fresh Record High As Dollar Rally Fizzles

It's deja vu all over again.

In a repeat of yesterday's session, where US equities and the dollar levitated in a one-way trade, Tuesday's muted session - where in addition to closed China and South Korean markets, Germany's Dax is also shut for holiday - has seen early dollar and European equity strength, while the S&P is set for new record highs amid higher E-minis and a VIX that is again lower after 5 consecutive days of declines.