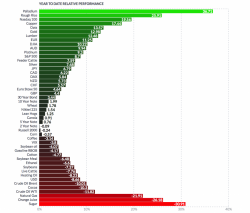

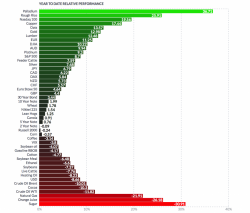

Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

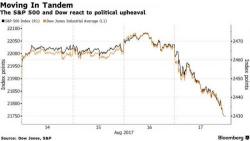

Traders barely had time to enjoy the lull from the "Armageddon trade" - the rising possibility of a nuclear exchange between the US and North Korea, which peaked over the weekend when various US officials said a nuclear war is not imminent, echoed by a statement by N. Korea's state-run news agency KCNA, before a new set of worries promptly took over, chief among them the ongoing slow motion train wreck in Donald Trump's administration coupled with yesterday's double terrorist attacks in Spain.

The global risk-off mood accelerated overnight on Trump "stability concerns", coupled with fallout from the Spain terrorist attack and lingering North Korea tensions, even if the VIX is off its latest highs, trading just above 15. Investors fled into German and U.S. Treasury bonds and bought gold for the third day in a row, as the appeal of such top-notch assets grew further due to a deadly attack that killed at least 13 people in Barcelona.

Authored by Henrik Choy via NationalInterest.org,

Can common enemies and threats keep Britain and the United States together for decades to come?

The first time we laid out the dire calculations about what is perhaps the biggest mystery inside China's financial system, namely the total amount of its non-performing loans, by former Fitch analyst Charlene Chu we called it a "neutron bomb" scenario, because unlike virtually every other rosy forecast the most dire of which topped out at around 8%, Chu argued that the amount of bad debt in China was no less than a whopping 21% of total loans.