The Biggest Real Estate Bubble Of All Time Just Did The Impossible

One month ago, we said that "the Vancouver housing bubble Is back, and it's (almost) bigger than ever."

One month ago, we said that "the Vancouver housing bubble Is back, and it's (almost) bigger than ever."

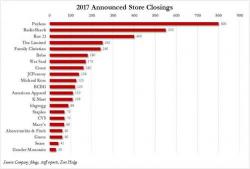

With the great retail bankruptcy tsunami claiming its latest victim on Thursday, when Gymboree announced it wouldn't make its June 1 interest payment guaranteeing a Chapter 11 bankruptcy filing in the next month, the signs continue to mount that the next "big short" - either in the form of REITs, CMBS, CMBX, or single name stocks as discussed here - is shorting America's bloated retail sector in general, and that staple of US "bricks and mortar" retailers in particular, the mall.

Visit Full Archives At The Entry Points

Authored by Adam Taggart via PeakProsperity.com,

The other day I was in my local branch of a Too Big To Fail bank where I have a few accounts. One of them is a savings account in which I keep some of my "dry powder" cash stored.

According to the prevailing narrative, job growth in the US, where GDP over the past decade has been on par with that in the 1930s, is one of the otherwise brighter economic indicators in a time when much of the economic data such as capital spending, productivity and especially wage growth (so critical for the Fed's future plans) has been a chronic disappointment. Today, for example, headlines blast that the US has enjoyed 80 months of continuous jobs growth with unemployment hitting 4.3% – the lowest since 2001.