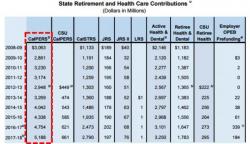

New Cali Budget Warns CalPERS Contributions "On Track To Double" In 6 Years

In his latest budget proposal, California Governor Jerry Brown, who continues to vehemently pursue various multi-billion dollar pet projects like the high-speed rail and the so-called "Delta Water Fix" despite his state teetering on the brink of insolvency, has finally admitted that CalPERS, California's public pension system, is a total disaster.