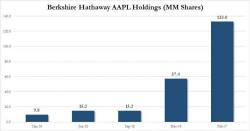

Confusion Ensues After Berkshire Reveals What Buffett Bought And Sold In Q1

There were at least two confusing items about Berkshire's just released 13-F filing.

First, as most wire services reported, Warren Buffett "increased" his stake in AAPL from 57.4 million shares as of December 31, to 129.4 million as of March 31 which is technically correct... except, on February 27 CNBC reported that Buffett had boosted his stake in Apple to 133 million shares, making him a top 5 holder.