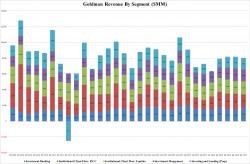

Goldman Misses As FICC Disappoints, Stock Slides As Average Banker Comp Hits $360K

Unlike the other big banks, Goldman's earnings release is a breeze: since the bank has virtually no balance sheet to use as a source of income (or loss), it is all about the income statement. And it was here that there was a big surprise, because despite expectations of a blowout result, with whisper numbers well above consensus estimates, Goldman unexpectedly disappointed, reporting Q1 revenues of $8.03BN, below the $8.53BN expected, translating to EPS of $5.15, fractionally below the $5.17 estimate, which nonetheless was 92% higher compared to EPS of $2.68 reported one year ago.