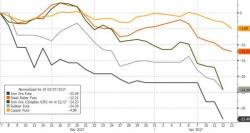

Commodity Carnage Crushes Trumpflation Hopes: "Everyone's Nervous The Bottom Is Falling Out"

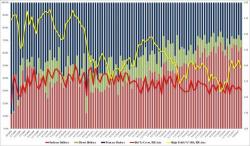

Another night of ugliness in Asia as the 'froth' is blasted out of the exuberant hot-money-chased commodity markets. Chinese steel and iron ore futures tumbled on Wednesday to the lowest prices in months as market sentiment turned bearish on the demand outlook.

As Reuters reports, China's producer price inflation cooled for the first time in seven months in March, pressured by fears that Chinese steel production is higher than demand, leaving a glut of the metal later this year.