Stocks Start Q2 With A Whimper: VIX Smash Saves Dow As Reflation Trade Is MIA

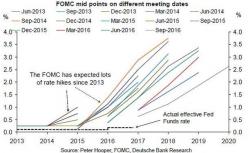

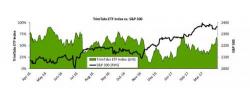

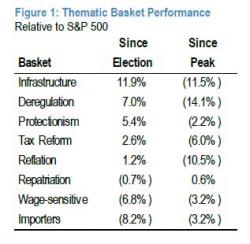

With an otherwise stellar Q1 ending with a whimper, traders expected that Monday would bring a return if not the "animal spirits", then at least the Reflation trade. That, however did not happen, for various reasons as profiled earlier by RBC, among which: