Central Banks Rethink 2% Inflation Target (In The Wrong Direction, Of Course)

Authored by Mike Shedlock via MishTalk.com,

If Central Banks wanted to make a positive impact on the global economy, they would abolish themselves and let the free market set rates.

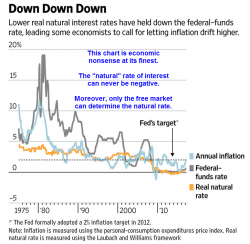

Instead, and after pursuing a 2% inflation target for decades, central bankers now ponder the need for even higher rates of inflation.

Rethinking Made Worse

Please consider Rethinking the Widely Held 2% Inflation Target.