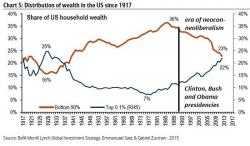

Do The Roots Of Rising Inequality Go All The Way Back To The 1980s?

Authored by Charles Hugh-Smith via OfTwoMinds blog,

Unless we change the fundamental structure of the economy so that actually producing goods and services and hiring people is more profitable than playing financial games with phantom assets, the end-game of financialization is financial collapse.