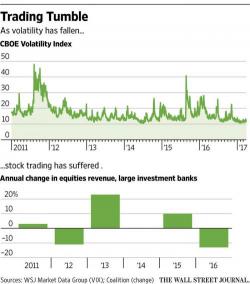

In Ominous Sign For Banks, Equity Trading Revenues Continue To Drop

It's not just the HFT industry that has cannibalized itself so much, while spooking regular traders out of the markets, there is hardly any revenue growth left (as the WSJ showed last week). After suffering a substantial drop in bank equity trading revenues over the past several years, there was hope that finally this key P&L items of sales and trading would post a modest pick up.