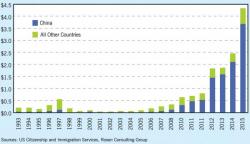

Chinese Elites Scramble To Apply For US 'Golden Ticket' Visa

As members of Congress in Washington debate raising the minimum required to obtain a U.S. immigrant investor visa from $500,000 to $1.35 million, Bloomberg reports concern about the hike has set off a scramble among wealthy would-be participants in China.