Banks Are Crashing

Party's over...

With the yield curve flatter than before Trump's election, and rates collapsing, reform was the last best hope for bank bulls...

And after Friday's debacle, it appears investors have lost patience...

Banks are now red YTD...

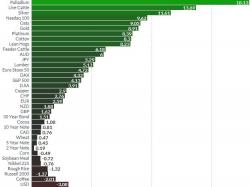

Think banks are oversold? Maybe not...