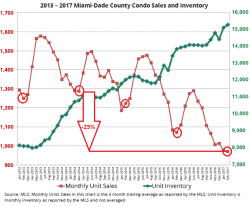

Condo Flippers In Miami-Dade Left Twisting In The Wind

By Wolf Richter of Wolf Street

Ballooning Condo Glut ensnares preconstruction speculators.

Miami-Dade’s spectacular condo flipping mania is in turmoil, with sales plunging, inventory-for-sale soaring, and new supply flooding the market. It’s not like Miami hasn’t been through this before.

In February, existing home sales of all types fell 10% year-over-year, to 1,835 homes. These sales “do not include Miami’s multi-billion dollar new construction condo market,” the Miami Association of Realtors clarified in its report on March 23.