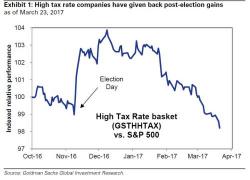

Goldman: "The Boost From Lower Taxes Will Now Be Smaller, Occur Later Than Expected"

With both JPM and Goldman having warned for months that the market is far too sanguine about the implementation (and effectiveness) of Trump's proposed domestic fiscal policies, Friday's events were a rude awakening for some, and framed how contentious the passage of any stimulus measures by the new president - one who as the WSJ writes this morning is realizing he misses a governing coalition - will be.