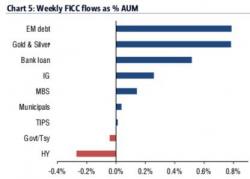

Biggest US Equity Outflows Since Brexit; US Banks Hit The Hardest

The latest evidence that rumors of Trumpflation trade's death are not greatly exagerated came overnight from Bank of America which reported that based equity funds saw net outflows of $8.9 billion, the largest in 38 weeks. The most impacted sector was, not surprisingly, banks - the biggest beneficiary of the post-Trump election victory rally, which suffered the biggest outflows in over a year.