Credit Crash Concerns Spark Biggest Investor Underweight Since 2008

Alarm bells are starting to ring across multiple asset classes as we approach The Fed's first double-rate-hike-in-3-months since 2006. The most concerning canary in the coalmine is US credit markets...

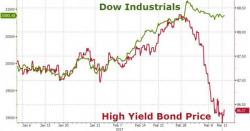

After a bigly run-up from the Feb 2016 lows - on the heels of unprecedented central bank cooperation - IG bonds began to break bad shortly after Trump's election and HY bonds began to collapse as The Fed stepped up its jawboning and after Trump's address to Congress...