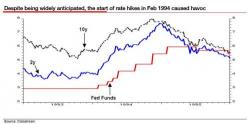

Bill Gross: "Our Financial System Is A Truckload Of Nitroglycerin On A Bumpy Road"

Courtesy of Bill Gross' latest monthly letter "Show Me The Money", here are some perspectives on the only thing that has kept the global economy going since the financial crisis: debt, and lost of it.