"Anything Can Happen" - Is Now The Time To 'Fade The Fed'?

Via Kevin Muir of The Macro Tourist blog,

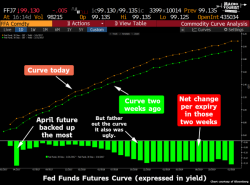

Last week’s hawkish Federal Reserve guidance sent the front end of the yield curve for a tailspin. In the process, the odds of a March hike went from less than 50% to almost 100%.

The movement in the Fed funds futures curve was swift and vicious. The whole curve shifted higher (in terms of yield), but the April future backed up the most.