Central Banks Need To Start Shocking Traders (Video)

By EconMatters

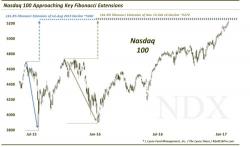

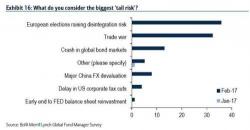

We discuss how traders are in a Euphoric Bubble Mentality where they can buy every dip and feel there is no risk of losing money in a Market Environment similar to other Market Bubbles at the Euphoria Stage of Excessive Risk Taking. The Fed Needs to Raise Rates 50 Basis Points at the March Meeting!

https://www.youtube.com/watch?v=bq4CoSlcCKA