Banks Bruised As Bond Yields Crash To 2017 Lows; Dollar Drops, Gold Pops

One of those days...

Once again European concerns are front and center...

And EURUSD vol is starting to spike...

One of those days...

Once again European concerns are front and center...

And EURUSD vol is starting to spike...

Submitted by Ronan Manly, BullionStar.com

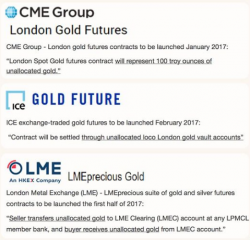

The second half of 2016 saw announcements by three exchange providers for plans to compete in the London Gold Market through offerings of exchange-traded London gold futures contracts.

With the IMF and Germany again at each other's throats over the neverending drama that is Greece, German Finance Minister Wolfgang Schaeuble repeated the same line he has used since the third Greek bailout from the summer of 2015, and in response to the IMF's demands for a reduction in Greek debt and fiscal surplus, the German ruled out a debt cut for Athens "as a violation of European rules", adding that "the country would have to leave the euro area to do so."

The full archive is at Trader Scott's Marget Blog.

It appears the machines were primed (or someone had coordinated) as the weak 10Y Treasury auction has sparked a notable surge in USDJPY (Yen selling) and Gold weakness as the world's biggest pairs trade continues...