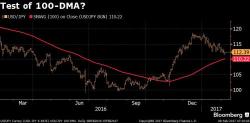

Bank Stocks Are Sliding... Testing Key Technical Support

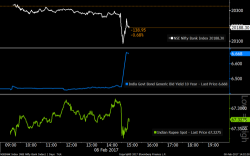

With bond yields tumbling, and loan markets suggesting banks are not taking advantage of rising rates to earn more NIM (willingness to lend tumbling), financial stocks are tumbling for the second day in a row to a key technical support level...

the green line (50-day moving average) has held for 3 weeks...

Close up - its clear the 50-day moving-average has been key support...

Makes you wonder what credit markets know?