We Just Witnessed A New “Lehman Brothers Moment”, And It Threatens To Unleash A Frenzy Of Panic On Wall Street

In today’s fast-paced world, companies need to adapt if they want to stay relevant. Even the Big Tech giants can’t get too comfortable—to remain competitive, large corporations like Google and Amazon are constantly innovating and evolving.

This holiday season is certainly going to be far less jolly for millions of Americans. Yesterday, I detailed 11 signs that economic activity in the U.S. is rapidly declining. Well, today we have gotten even more bad news. Thanks to deteriorating economic conditions, Americans plan to buy a lot less stuff this holiday season. In fact, one survey that was just released has discovered that approximately half the country plans to “buy fewer things” this year…

By Brandon Smith

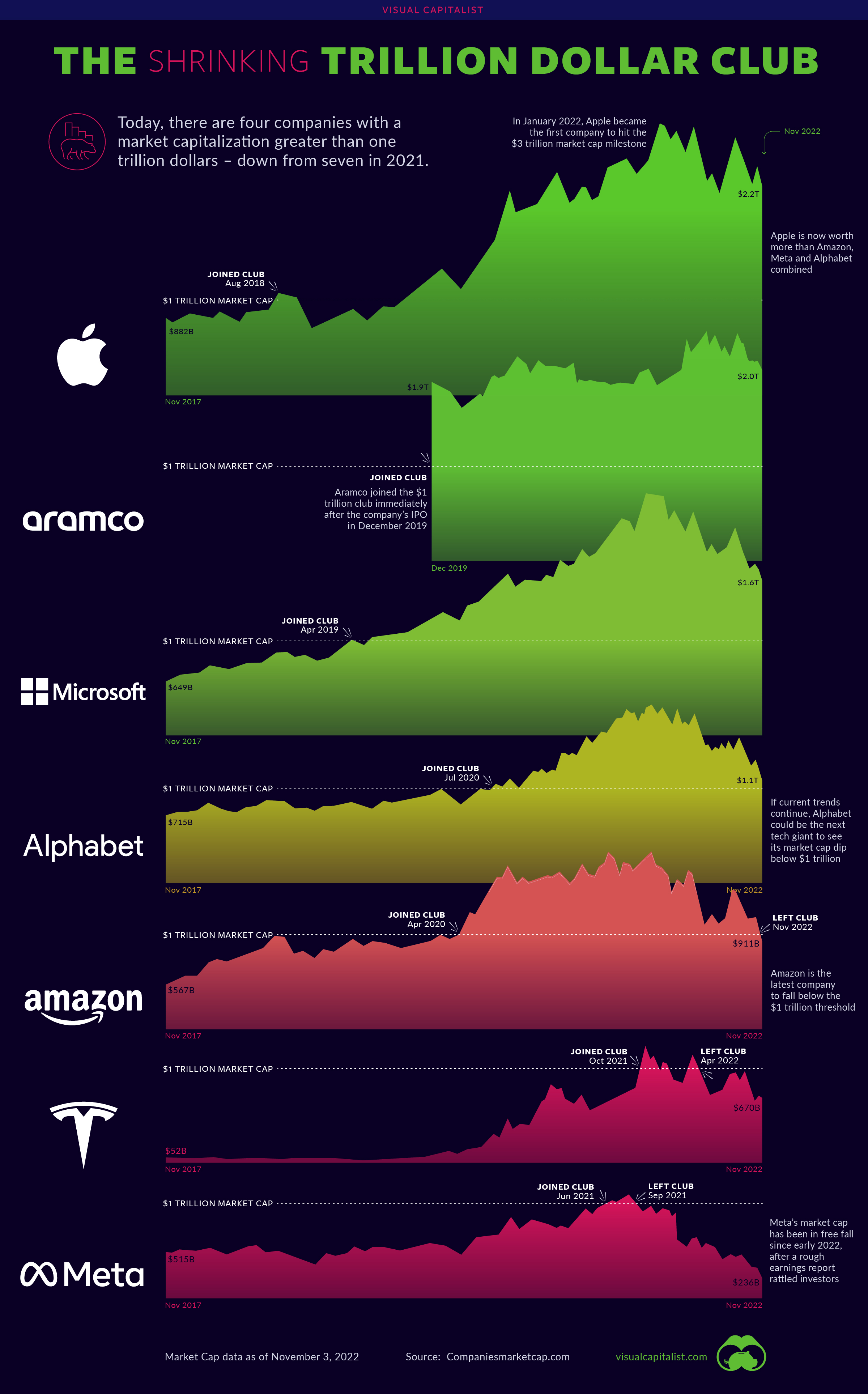

The Shrinking Trillion Dollar Club

Aggressive tightening from the Federal Reserve has caused tech stocks to plummet back to Earth in 2022, and this has shaken up the membership of the trillion dollar market cap club.

Here are the four current members of this exclusive club: