Rationing Has Already Started In Europe As The Entire Globe Plunges Into A Horrific Economic Nightmare

Subscribe to the Elements free mailing list for more like this

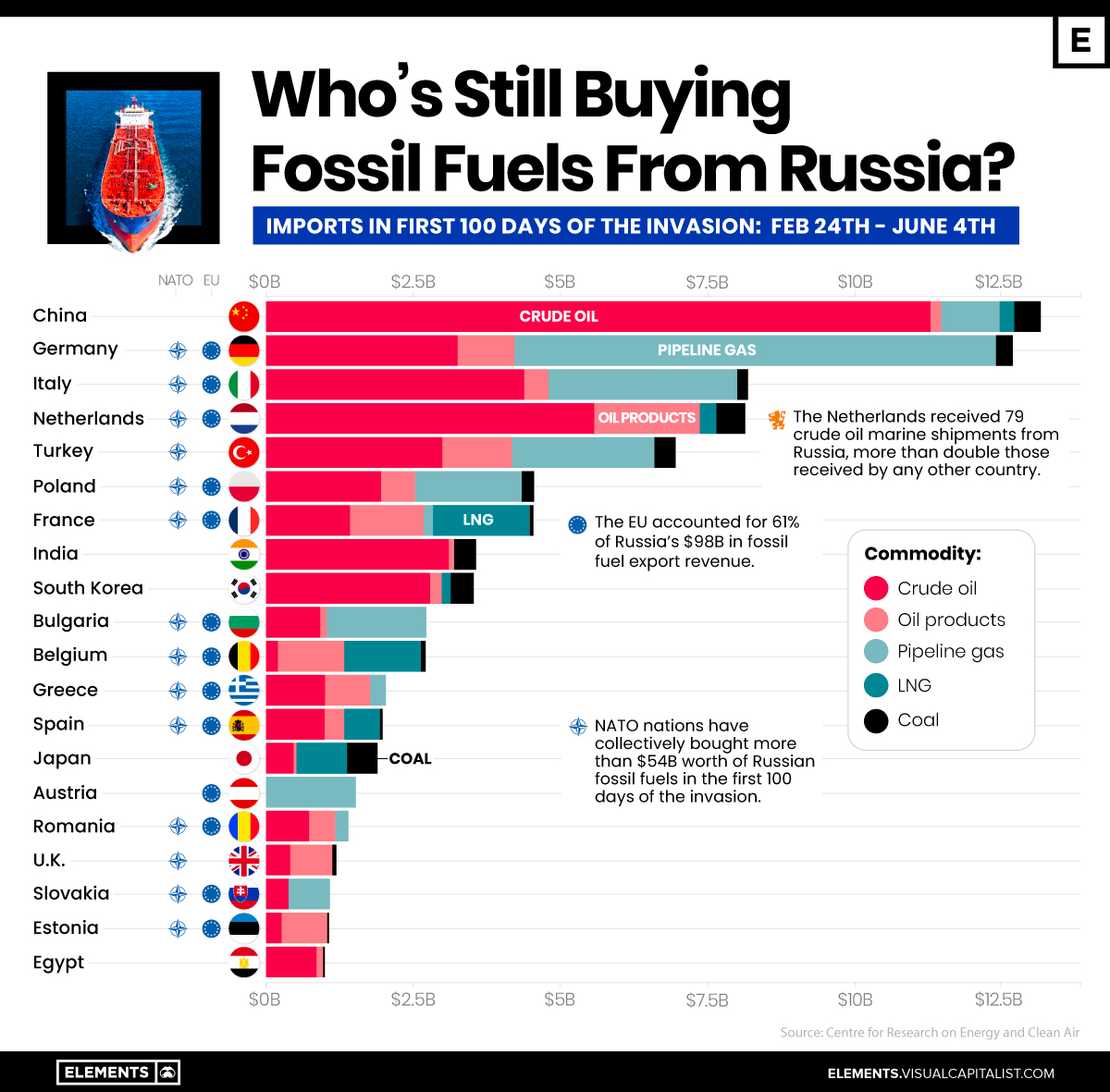

The Largest Importers of Russian Fossil Fuels Since the War

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

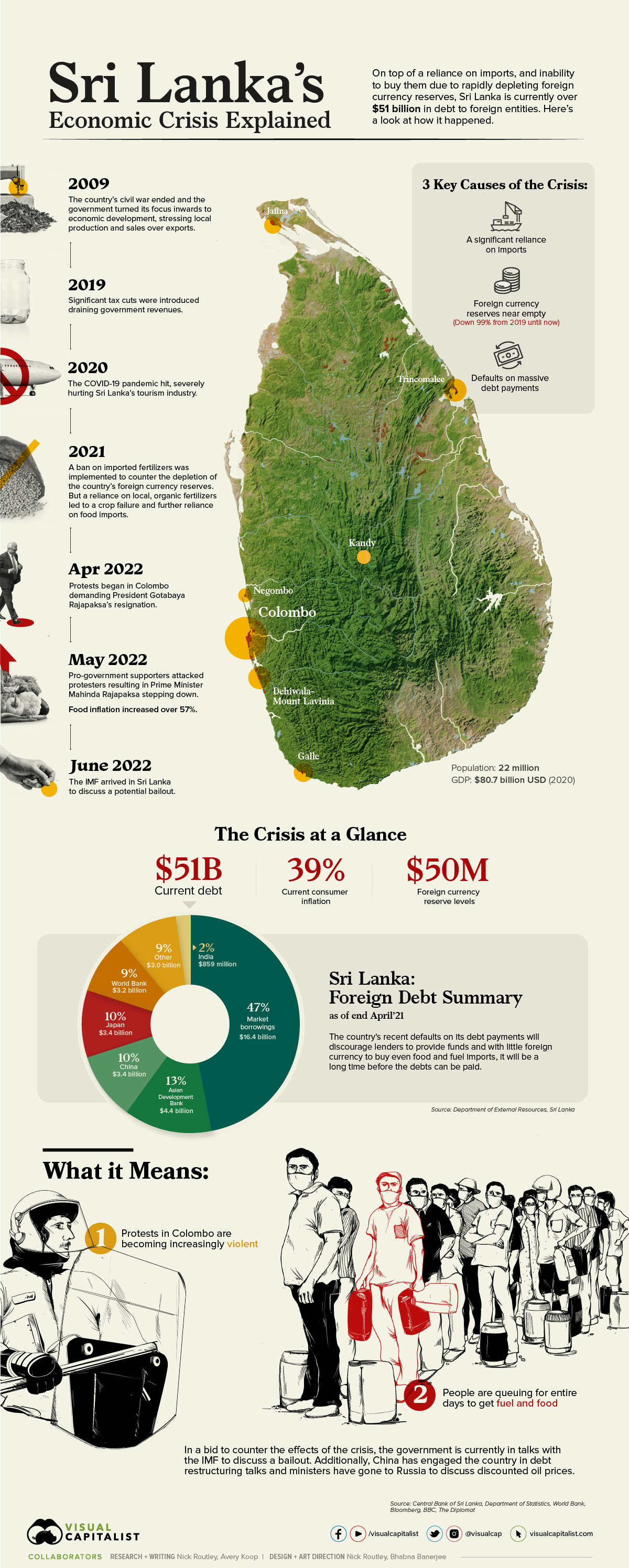

Explained: the Economic Crisis in Sri Lanka

Sri Lanka is currently in an economic and political crisis of mass proportions, recently culminating in a default on its debt payments. The country is also nearly at empty on their foreign currency reserves, decreasing the ability to purchase imports and driving up domestic prices for goods.

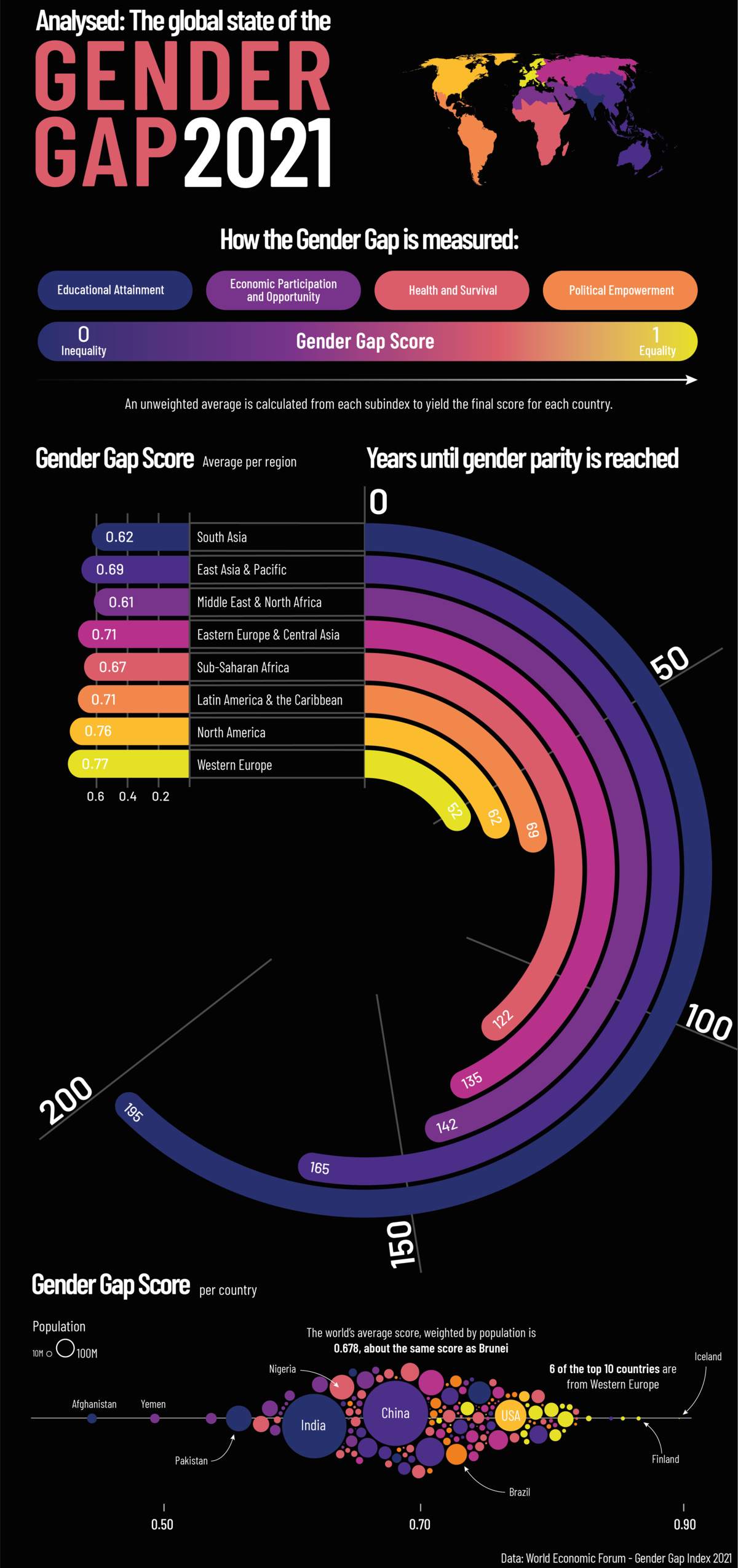

The Current State of the Global Gender Gap

As a global society, we still have a long way to go before we reach gender equality around the world.

According to the World Economic Forum’s (WEF) latest Global Gender Gap Report, it could take up to 135.6 years to close the global gender gap, based on the current rate of change.