Your Standard Of Living Is Being Systematically Destroyed

Subscribe to the Elements free mailing list for more like this

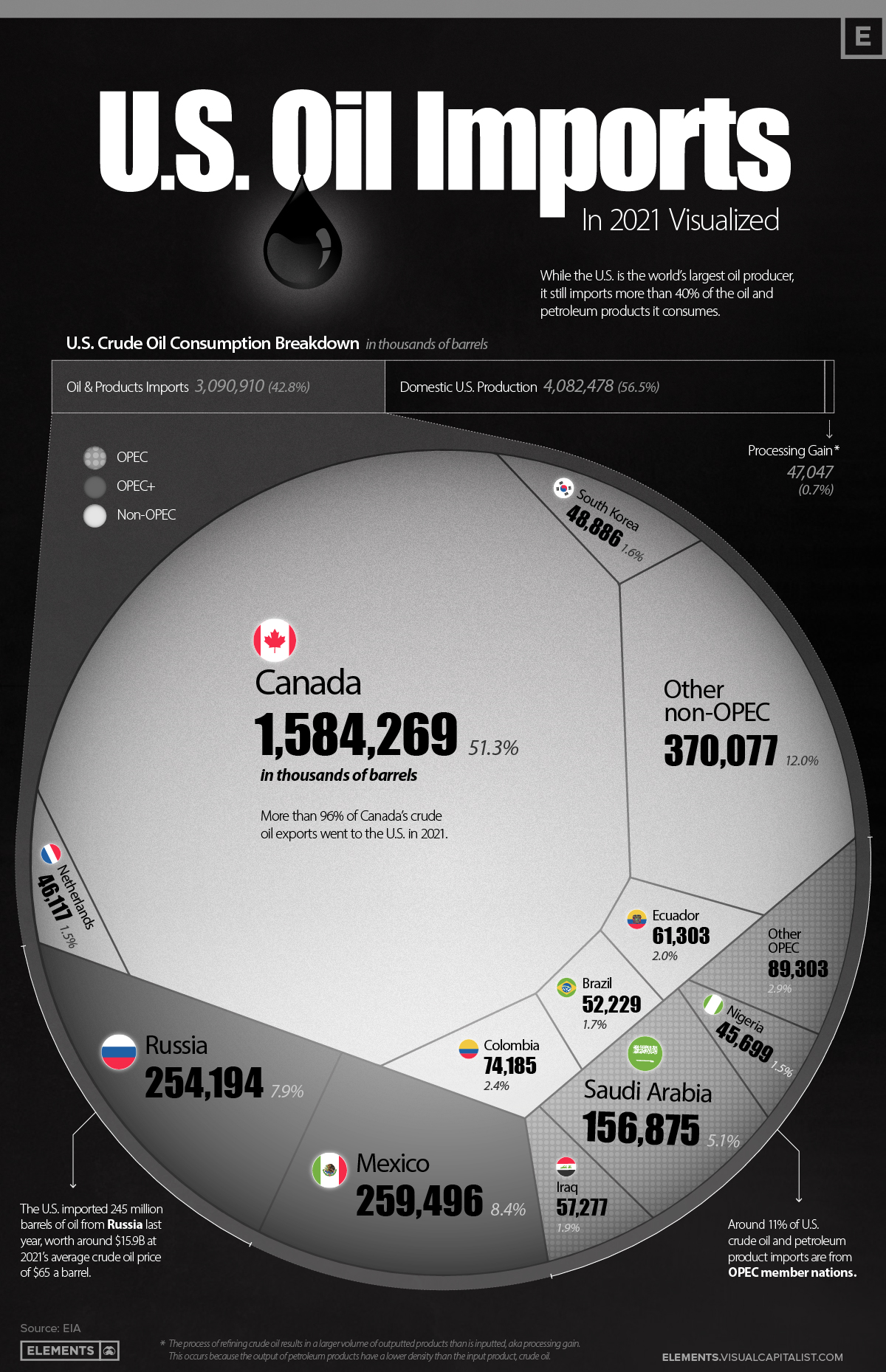

U.S. Petroleum Product and Crude Oil Imports in 2021: Visualized

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

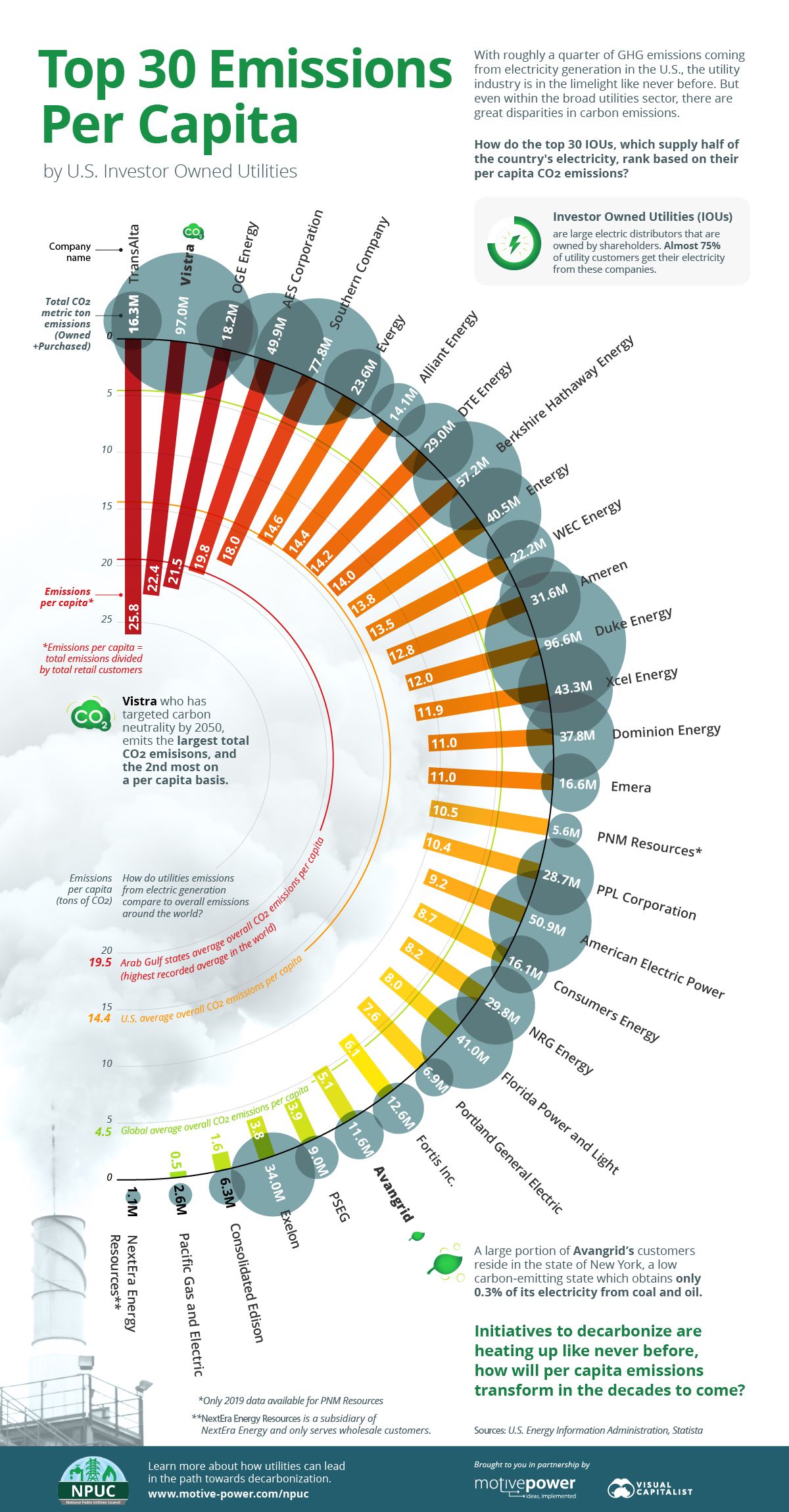

The following content is sponsored by the National Public Utilities Council

Emissions per Capita of the Top 30 U.S. Investor-Owned Utilities

Approximately 25% of all U.S. greenhouse gas emissions (GHG) come from electricity generation.

The Top Downloaded Apps in 2022

Whether they’re providing a service like ride-sharing or acting as a mere source of entertainment, mobile apps have become an integral part of many peoples’ day-to-day lives.

But which apps are most popular among users?

This graphic uses data from a recent report by Sensor Tower to show the top 10 most downloaded apps around the world in Q1 2022 from the Google Play and Apple App Store.

By Brandon Smith

Four years ago the overall sentiment among most alternative and mainstream economists was that the Federal Reserve would NEVER hike interest rates, taper stimulus or reduce their balance sheet into economic weakness. In fact, this was one of the few viewpoints that the mainstream media and independent economists actually agreed on. A few of us had different ideas, though.